Top TN court ‘pay-to-play’ rule challenged

Hirsch insists privilege taxes are payable only by attorneys and clients, not by people appealing by right who are not themselves using a state privilege

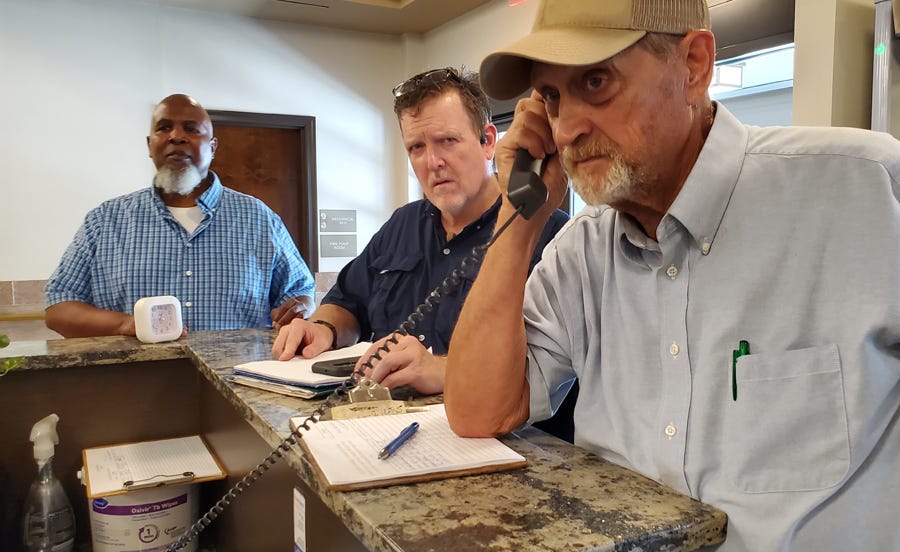

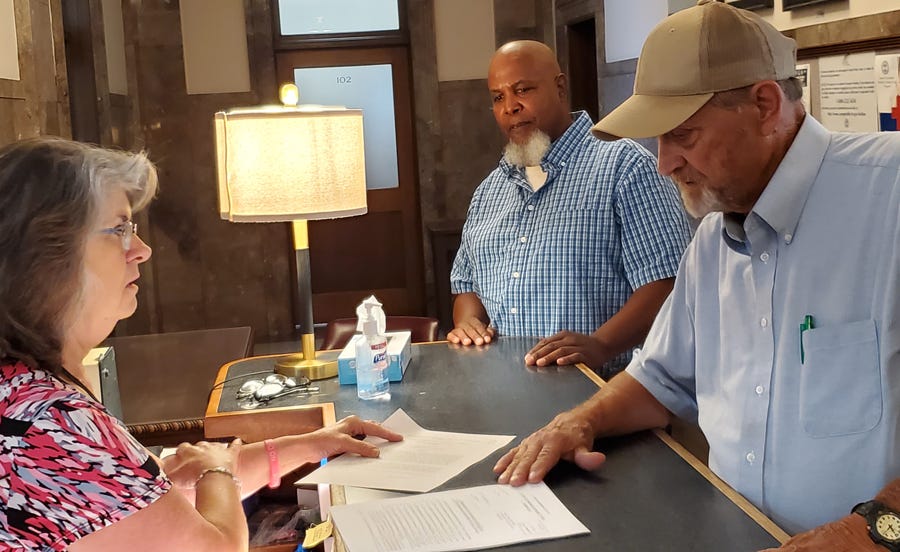

A Lawrenceburg, Tenn., man known for his Christian “Fiddleman” ministry among nursing home seniors and jail inmates is demanding the Tennessee Supreme Court step lively under the state bill of rights.

Arthur Jay Hirsch in appeal of a criminal case is going directly to the Supreme Court challenging a rule that requires all comers to pay $550 before they can get into the court of appeals..

Says Hirsch, 73, an independent business man, “These justices are imposing a pay to play scheme — it’s justice for sale in Tennessee, a privilege tax extracted from people not even liable to pay the tax because they’re not lawyers.”

Hirsch is appealing a conviction in Lawerence County of driving on a suspended license, a 6-year-old case and he is appealing pro se, without an attorney.

Hirsch cites Tennessee Constitution, Art. I, § 17, the clause guaranteeing courts open for justice without "sale, denial, or delay," and a catch-all constitutional provision at Art. XI, § 16 that absolutizes the ban on bill of rights transgressions.

The litigation tax on lawyers is properly upon a privilege, his filings say, just as truckers pay privilege taxes to use the public road for private gain, or shopkeepers are taxed for the privilege of being open to the public for private profit, or dentists who pay a privilege tax for the state’s special favor letting them pursue an exclusive calling on top of patients’ tongues.

“Since bar-licensed attorneys derive personal financial benefit and profit from the privileged use of the publicly funded court system,” Hirsch says, “it is statutorally correct that all licensed attorneys be those subject to and liable for paying the required court litigation privilege tax and administrative fees. It is by law incorrect and unjust for the unlicensed general public to be forced to pay the privilege tax to exercise inviolable constitutionally secured rights.”

Hirsch says the tax is flatly unconstitutional, insisting, “Where rights secured by the Constitution are involved, there can be no rule making or legislation which would abrogate them,” quoting Miranda v. Arizona, 384 U.S. 436, 491 (1966).

Hirsch says "government is instituted for the ‘common benefit,’ and Tennesseans pay for the state court system with taxes.

“Charging citizens an additional ‘privilege tax’ for them to gain access to courts of justice – which they’ve already paid for – is double taxation. It’s just as absurd as parents having to pay a tax to enroll their children in public school, or to pay the fire department before they show up — or to hafta give your credit card number dialing 911.”

Early in the litigation the Supreme Court issued a unsigned denial in which it said, “The jurisdiction of the Supreme Court is appellate only.” However, Hirsch is not satisfied. “The Supreme Court has original jurisdiction over its own rules, and no lower court can take the case.