Key point in fighting back vs. traffic case abuse is ‘privilege’

Phillips v. Lewis lays out your defense of charges by cops, other actors of ‘commercial government’; what evidence can you testify today of commerce, private profit or gain?

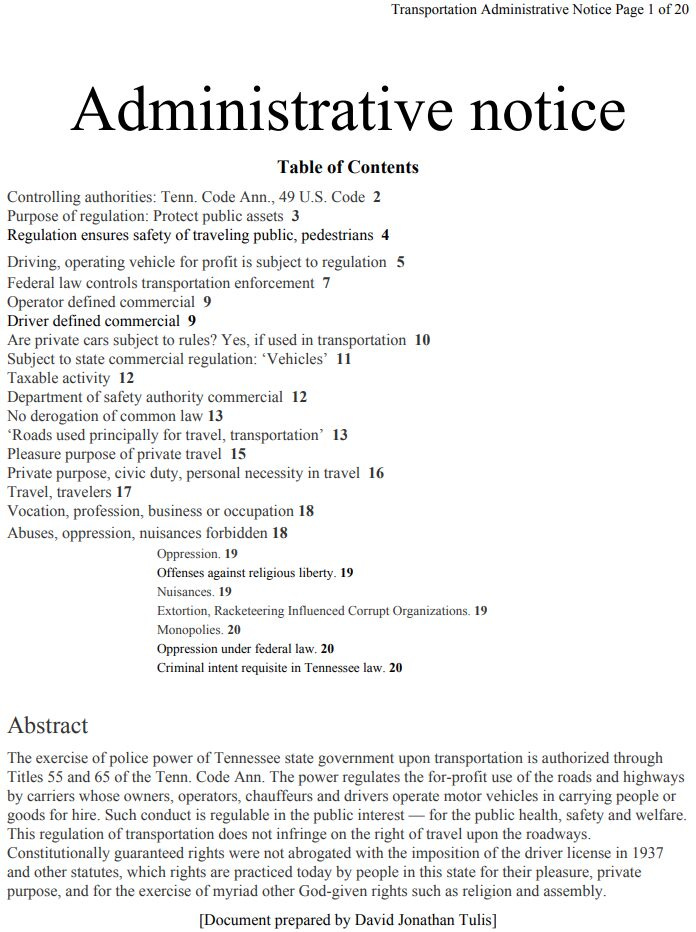

CHATTANOOGA, Tenn., Saturday, Sept. 28, 2024 — Until we find a proper petition to thwart commercial government, understanding privilege and presumption will let us defend ourselves in the meanwhile in traffic and other cases.

For decades lovers of liberty and constitutional government have relied on defending the right to travel in terms of the obvious right of free movement and communication. Since the defeat of Arthur Jay Hirsch’s appeal in 2017 in a right to travel case, it has become clear that the courts have built a legal fiction to block all enjoyment of ingress-egress rights.

The alternative theory is that traffic cases are privilege management and tax cases that make improper and rebuttable presumptions about whether tThe person with his right foot on the gas pedal and his two hands on the steering wheel is involved in state-owned and -protected privilege.

It’s a commonplace in general sessions court that driving is a privilege and not a right, with some judge going so far as to claim “you can’t use the public roadway without a license.” Driving and operating a motor vehicle are commercial activities subject to regulation and taxation.

Because everyone of the 50 states have gone commercial in their outlook and are controlled by profit-seeking rentier corporate interests, the liberties of the people have been forced to give way. The courts have admitted themselves into blindness. They are unwilling to see any defense of rights by the occasional crackpot and crank constitutional pro e defendant such as Ed Soloe or even me.

We can use the system with its administrative nether realms to make it destroy itself or to seize up, and that by proper petition against local law enforcement agencies and departments of safety and revenue.

Privilege is regulable activity

Driving is a privilege. Admitted. Got it. Granted 100 percent. But what about someone who wants to use the road apart from driving and operating? Why can’t this person use an automobile to go from Point A to Point B, in exercise of God-given and constitutionally guaranteed liberty?

What if a person with a “revoked” license or a “suspended” tag wants to travel apart from the privilege. Is he committing a crime? Is he really “driving on revoked”? If that person simply travels, has he violated the peace and dignity of the state and its people?

Until we get down to reading cases such as Phillips vs. Lewis we will remain a deservedly oppressed and eaten-out people. Mysteriously, this 1877 case is nowhere online, not even on Westlaw. The main point about privilege: If an activity is making money for private profit and gain, it is or may be subject to privilege regulation and taxation in the public interest under the tax power of the state. That’s how it is in Tennessee.

The presumption part of the equation is this: Everyone on the road is presumptively on the privilege when pulled over. But maybe, maybe, that day and that hour, they are not “on” the privilege in profit-making activity, but simply exercising a right, or pursuing a pleasure.

Phillips. V. Lewis, Shannon’s Code, Vol. III, p. 230, 1877

The case is between John W. Phillips as against W.G. Lewis, tax collector, January term 1877. The case focuses on Tenn. onst. Art 2, sect. 28, taxation.

‘Taxed not as proerty, but as occupation’

p. 238. The language is that hereafter the keeping of dogs shall be a privilege which shall be taxed as follows, etc. In this view of the question, the real point presented is whether the simple ownership of property of any kind can be declared by the legislature a privilege, and taxed as such, for if it can be done in the case of a dog, it may be done in the case of a horse, or any other species of property. It is clear this is what is done by this statute, except that [p. 239] it has gone even further, and taxed a party who shall harbor or give shelter to a cur on his premises. This latter privilege, we take it, is one that will not be much sought after, but to the main question. It is evident the words, “keeping of dogs,” in the statute mean simply ownership *** [.]

p. 240 “Merchants, peddlers and privileges,” are the defined objects of taxation in the latter clause of the section. It is certain the merchant is not taxed except by reason of his occupation, and in order to follow or pursue this occupation – one of profit – in which it may be generally assumed capital, skill, labor, and talent are the elements of success, and are called into play by its pursuit. This pursuit or occupation is taxed, not as property, but as an occupation. Another element of this occupation is, that its object and pursuit is directed to a profit to be made off the general public, the merchant having a relation, by reason of his occupation, to the whole community in which he may do business, by reason of which he reaps, or is assumed to reap, the larger profit by drawing upon or getting the benefit of the resources of those surrounding him. The same idea is involved in the case of the peddler, who may range over a whole county by virtue of his license. His is an occupation of like character, a peculiar use of his capital, varied only in some of its incidents.

‘Using the jackass for profit in propagation of stock’

These occupations are taxed as such, and not on the ad valorem principle. So we take it the word privilege was intended to designate a larger, perhaps an indefinite class of objects, having the same or similar elements in them, distinguishing them from property, and these objects were to be defined by the legislature and taxed in like manner as might be deemed proper. But the essential element distinguishing the two modes of taxation was intended to be kept up. That is the difference between property and occupation or business dealing with and reaping profit from the general public, or peculiar and public uses of property by which a profit is derived from the community. ***

Page 241. The case of Marbury v. Tarver, 1 Hum. 94, was under the Act of 1835 *** prohibiting the keeping, or rather, using the jackass for profit in the propagation of stock. Here it is clear it was the keeping of the animal, and using him for profit to be derived from the public in a particular manner, that was declared to be a privilege and taxed as such. It is not a tax on the jack, or for owning him or harboring him as the case before us, but a tax upon the particular public use to which he is put, that makes the element of privilege in that case.

‘Occupation, avocation, or calling’

p. 243 We may concede, as we understand the argument of the Attorney General to do, that an actual license issued to the party is not an essential feature of a privilege, but is only the evidence of this grant of the right to follow the “occupation or pursuit,” and the usual and perhaps universal incident to such grant, or that a tax receipt is, or even may be the evidence of the grant. Still, the thing declared to be a privilege is the occupation, the license but the incident to its engagement, described by statute, assuming, however, the license in one form or the other is to be had. We think it would be impossible to hold, in any accurate sense, that a man could only be entitled to hold and possess his property, paid for with his money and earned by his labor, upon the condition of obtaining a license, either from the county clerk, or a tax collector. His right is indefeasible under the constitution of the state. He can only be deprived of it by due process of law, or the law of the land as hereinafter explained.

P.244 “[T]he tax is on the occupation, avocation, or calling, it being one in which a profit is supposed to be derived, by its exercise, from the general public.